sacramento tax rate calculator

As far as sales tax goes the zip code with. This calculator does not figure tax for Form 540 2EZ.

Sacramento is located within Sacramento County California.

. The median property tax on a 32420000 house is 340410 in the United States. By clicking Accept you agree to the terms of the. Sales Tax Calculator Sales Tax Table.

075 lower than the maximum sales tax in CA. For questions about filing extensions tax relief. CDTFA public counters are now open for scheduling of in-person video or phone appointments.

The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a. What is the sales tax rate in Sacramento California. The California sales tax rate is currently.

Under California law the government of Sacramento public schools and thousands of other special purpose districts are given authority to appraise housing market value fix tax rates and bill the tax. The sales tax jurisdiction name is Sacramento Tmd Zone 1 which may refer to a local government division. Sacramento in California has a tax rate of 825 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Sacramento totaling 075.

Sacramento County Sales Tax Rates Calculator Method to calculate Sacramento sales tax in 2021. Did South Dakota v. A supplemental tax bill is created when a property is reassessed from a change in ownership or new construction.

Sacramento County has one of the highest median property taxes in the United States and is ranked 359th of the 3143 counties in order of. The Sacramento California sales tax is 825 consisting of 600 California state sales tax and 225 Sacramento local sales taxesThe local sales tax consists of a 025 county sales tax a 050 city sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc. The December 2020 total local sales tax rate was also 8750.

The minimum combined 2022 sales tax rate for Sacramento California is. Sacramento County collects on average 068 of a propertys assessed fair market value as property tax. Sacramento County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Sacramento County totaling 025.

Ad Manage sales tax calculations and exemption compliance without leaving your ERP. Sacramento Sales Tax Rates for 2022. Your employer withholds a 62 Social Security tax and a 145 Medicare tax from your earnings after each pay period.

Arts and Culture Calendar. You can find more tax rates and allowances for Sacramento and California in the 2022 California Tax Tables. This includes the rates on the state county city and special levels.

Sales Tax Table For Sacramento County California. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010.

The property tax rate in the county is 078. Sacramento in California has a tax rate of 825 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Sacramento totaling 075. 2022 City of Sacramento.

For questions about filing extensions tax relief and more call. Sales Tax Data Special Business Permits Starting a Business Taxes and Fees Visitors. The County sales tax rate is.

Please contact the local office nearest you. After searching and selecting a parcel number click on the Supplemental Tax Estimator tab to see an estimate of your supplemental tax. Census Bureau American Community Survey 2006-2010 The Tax Foundation.

Within Sacramento there are around 48 zip codes with the most populous zip code being 95823. What is the sales tax rate in Sacramento California. If you earn over 200000 youll also pay a 09 Medicare surtax.

Please visit our State of Emergency Tax Relief page for additional information. Our Sacramento County Property Tax Calculator can estimate your property taxes based on similar properties. All numbers are rounded in the normal fashion.

The current total local sales tax rate in Sacramento CA is 8750. To calculate the sales tax amount for all other values use our sales tax calculator above. This is the total of state county and city sales tax rates.

Businesses impacted by recent California fires may qualify for extensions tax relief and more. The Sacramento Sales Tax is collected by the merchant on all qualifying. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 819 in Sacramento County California.

The Sacramento sales tax rate is. The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025 Sacramento County sales tax 1 Sacramento tax and 15 Special tax. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes.

All are public governing bodies managed by elected or appointed officers. The average cumulative sales tax rate in Sacramento California is 841. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare.

Avalara provides supported pre-built integration. Use the 540 2EZ Tax Tables on the Tax Calculator Tables and Rates page. The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year.

Taxi Fare Calculator Sacramento California

Sacramento County Transfer Tax Who Pays What

Infographic Fha Inspection Checklist Lender411 Com

Pin On Gobig Real Estate Realtors Home Inspection

2022 Best Sacramento Area Suburbs To Live Niche

Sacramento Kings Will Offer Bitcoin As Salary To Players

The Health Crisis Slowed The Market This Spring So Buyers Are Jumping Back Into The Market To Make Their Moves This Real Estate Things To Sell Home Ownership

Sacramento California Local Barber Shop Photo Photography Portfolio Photography Branding Branding Photos

Benefit Calculator Sacramento County Employees Retirement System

Best Cheap Car Insurance In Sacramento Bankrate

Hotel Policies Hyatt Regency Sacramento

Services Rates City Of Sacramento

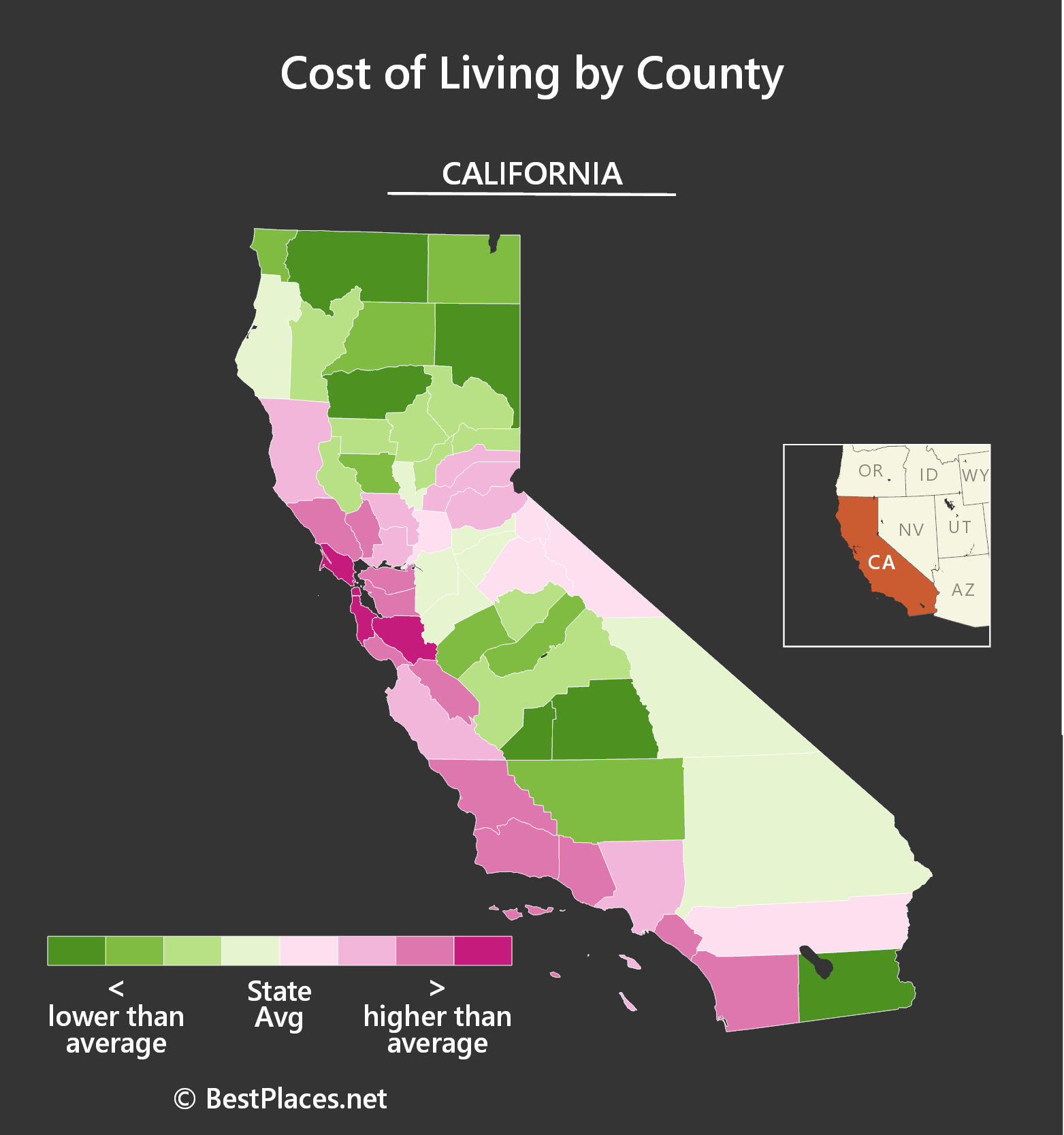

Best Places To Live In Sacramento California

How Sacramento County Leveraged Technology To Put People At The Center Of The Covid 19 Response

Top 20 Cities In U S For Investing In Real Estate Rentals